" Türkiye is Fighting Inflation in Five Dimensions”

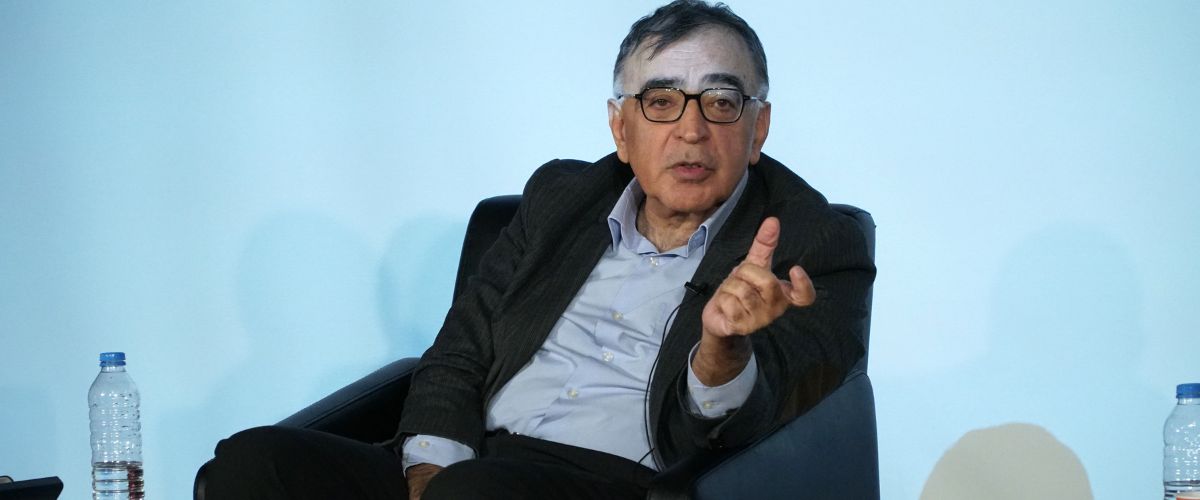

Prof. Dr. Hayri Kozanoğlu made comprehensive evaluations on Türkiye's fight against inflation.

Prof. Dr. Hayri Kozanoğlu made comprehensive evaluations on Türkiye's fight against inflation. Speaking at the panel “The Present and Future of the Turkish Economy in the 101st Anniversary of the Republic”, Altınbaş University Faculty Member Prof. Dr. Hayri Kozanoğlu stated that monetary policy is one of the main tools in this struggle and drew attention to the gradual increases in the policy rate. The policy rate, which was 8.5 percent before the 2023 elections, rose up to 50 points in the following period. However, he emphasized that bringing inflation under control with tight monetary policy becomes difficult when results cannot be achieved in a short time. Here, if you cannot get a shock effect in a short time, you cannot reach a result. The effects of all of these are seen in Türkiye.”

The panel organized in cooperation with Altınbaş University Faculty of Business Administration and MÜMAD was moderated by Vahap Munyar, President of the Turkish Journalists Association and Journalist-Author. Prof. Dr. Mehmet Şişman, Prof. Dr. Burak Arzova and Dr. Bader Arslan were among the speakers at the panel, where important evaluations were made on Türkiye's past economic crises.

Distortion of pricing behavior

Prof. Dr. Kozanoğlu drew attention to the concept of “deterioration of pricing behavior” in the fight against inflation. Explaining this expression, which is frequently mentioned by the Minister of Treasury and Finance Mehmet Şimşek, Kozanoğlu stated that companies and markets tend to exorbitant price increases in a high inflation environment. He emphasized the difficulty of controlling this so-called “sellers' inflation” without regulations and inspections.

Preference for financial gain over production in industry

Discussing the effects of the high interest rate environment on the industrial sector, Kozanoğlu said that especially small and medium-sized enterprises are crushed under the burden of high interest rates. He stated that these conditions led some companies to seek financial gain instead of production. As a result, the supply of goods and services in the market decreased and negatively affected the economic balance. “Interest is a cost for companies. This cost increases as the duration of the fight against inflation increases. After all, the most important issue in the economy is supply and demand. It prevents supply, that is, the provision of more goods and services to the market.” Stating that this was seen very clearly in the early 2000s, Kozanoğlu said, “Industrial companies, especially medium and small enterprises, are crushed under the burden of high interest rates. Naturally, they may prefer to make money from money and to produce.”

The role of expectations

Drawing attention to the critical role of inflation expectations in the economy, Kozanoğlu emphasized that inflation expectations of the real sector and individuals are still high. He said that this situation causes individuals and companies to risk borrowing at high interest rates. He pointed out that if inflation does not fall rapidly, this will make economic balances even more difficult, especially the uncollectible receivables that have been signaling recently will increase further, and a debt repayment problem will emerge.

“Five-dimensional fight against inflation”

Prof. Dr. Kozanoğlu stated that Türkiye is currently struggling with inflation in five different dimensions and that the longer this process continues, the more difficult the solution will become. The negative impact of tight monetary policy, pricing behavior, deterioration of the supply-demand balance, individual and corporate indebtedness, and the failure to implement fiscal policies, especially in terms of taxing the wealthy and money-making sectors, stand out as the key points of the fight against inflation.

According to Kozanoğlu, an effective fight against inflation requires comprehensive regulations and social awareness in addition to policy instruments. Only in this way can long-term and permanent solutions be produced.